The information below consists of general information on how to purchase municipal securities and other general information relating to municipal securities and securities issued by LADWP. This website is not an offer to sell or solicitation of an offer to buy bonds or notes. Bonds or notes may only be purchased through an Official Statement and a broker.

- What are the opportunities for individual investors to buy LADWP Bonds?

- What are the steps to buy LADWP bonds?

- What does it mean when a bond or note is tax-exempt?

- What are some benefits of purchasing municipal securities?

- What are some risks involved in investing in municipal securities?

- What are the key features of LADWP municipal securities?

- What if I want to sell my municipal securities prior to maturity?

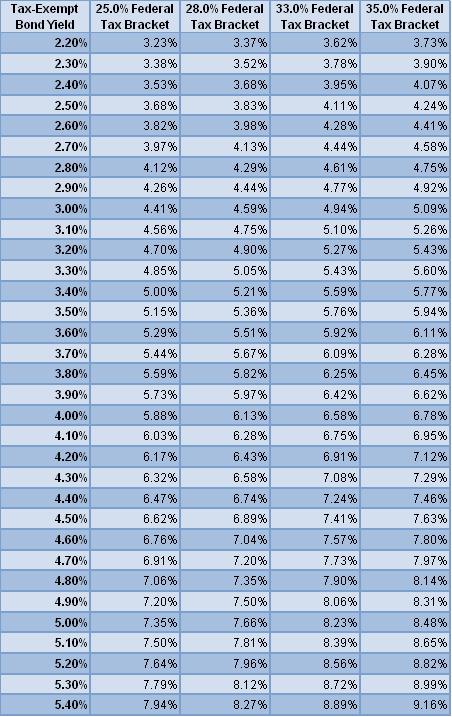

- How do I compare tax-exempt municipal securities to taxable investment alternatives?

- What is the difference between buying municipal securities in the primary and secondary market?

- What is a Revenue Bond?

- For certain offerings, individual investors get to place their orders before institutional investors, such as mutual funds or insurance companies.

- They earn the same investment return as institutional investors who buy the same bonds or notes.

- They do not pay the upfront brokerage fee/commission. (Individuals should check with their broker to learn about any other transaction or account maintenance fees.)